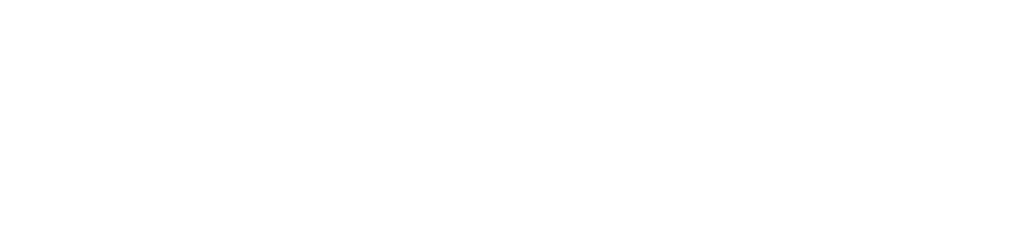

In today’s fast-paced freelance economy, working with international clients presents a unique set of challenges, particularly when it comes to receiving payment. From delayed wire transfers and hefty currency conversion fees to juggling multiple platforms for fiat and crypto payments, freelancers often face serious friction just to access their hard-earned money. Here’s where FV Bank makes a difference. A fully licensed U.S. digital bank that combines the reliability of traditional finance with the innovation of blockchain technology. FV Bank offers a seamless, all-in-one solution designed to simplify global payments for modern freelancers — wherever they’re based, and however they choose to get paid. The Global Payment Struggle Is Real A global survey found 58% of freelancers feel underserved by banking systems. Many miss out on jobs due to limited payment options, and wire transfers remain slow and expensive. Currency conversions reduce income, and switching between platforms introduces inefficiency. With rising demand for digital assets, 93% of freelancers now prefer to receive part of their income in stablecoins. In regions like Argentina, where currency volatility is high, over 80% prefer stablecoin payments over local currency. A Unified Account for Global Freelancers FV Bank offers a U.S.-based digital bank account with support for ACH, Fedwire, and SWIFT, enabling payments from clients in over 200 countries. Freelancers can receive both USD and digital currency payments such as stablecoins directly into a single account, with funds auto-converted to USD and credited instantly. Whether your client is in the U.S., Europe, Africa, or Asia, you get one platform to manage all your incoming payments — no need for separate accounts or platforms. Sending money is just as seamless. Pay vendors globally using SWIFT, local wires, or in 10+ major currencies, including EUR, GBP, JPY, SGD, CAD, MXN, and AED — all without needing to hold balances in multiple currencies. Digital Assets and Stablecoins: Speed, Savings, and Simplicity FV Bank offers native support for stablecoins, enabling seamless transactions in USDC, USDT, and PYUSD. Freelancers can receive payments directly in stablecoins from clients, which are automatically converted to USD and credited to their FV Bank account in real-time. In addition, freelancers can also send payments in stablecoins — the USD in their account is automatically converted to the chosen stablecoin at the time of transfer. This eliminates the need for complicated wallets, conversions, or off-ramp services, resulting in faster, lower-cost transactions. In addition, FV Bank allows you to securely custody digital assets like Bitcoin, Ethereum, and stablecoins within the same account, with the ability to convert them to USD as needed — all managed through a unified dashboard. This level of flexibility is particularly valuable in regions with currency volatility or limited banking access, empowering freelancers with greater control over how they earn, hold, and move money globally. Whether You’re an Individual or a Company — We’ve Got You Covered FV Bank offers account options for both individuals and companies. Whether you’re a freelancer managing personal payments or a growing business handling global transactions, you can choose between our Individual Plus or Business Plus accounts to suit your needs. FV Bank is built to grow with you, from independent creators to international teams. Instant Spending with the FV Bank Visa Card With FV Bank’s Visa debit card, your funds are ready to use the moment they arrive, from wire, ACH, or stablecoin. You can spend online, pay subscriptions, travel, or withdraw cash at ATMs worldwide. You can also convert and spend your crypto holdings directly from your account — no need for external wallets or exchanges. Received 1000 USDC? Have it converted to USD and spend it instantly. Freelancers can issue business expense cards for team members, apply spending controls, and track activity in real time, simplifying expense management and accounting. The Future of Freelance Payments Imagine invoicing a client overseas. They pay in stablecoins. Your USD balance updates instantly. You use your Visa card to cover business costs — no delays, no extra steps. That’s not the future — that’s FV Bank today! As stablecoins and freelance work continue to grow, FV Bank is perfectly positioned to support modern professionals with a global, crypto-friendly, and bank-backed solution. If you’re ready to streamline how you earn, manage, and spend money globally, FV Bank is the banking partner you’ve been waiting for.